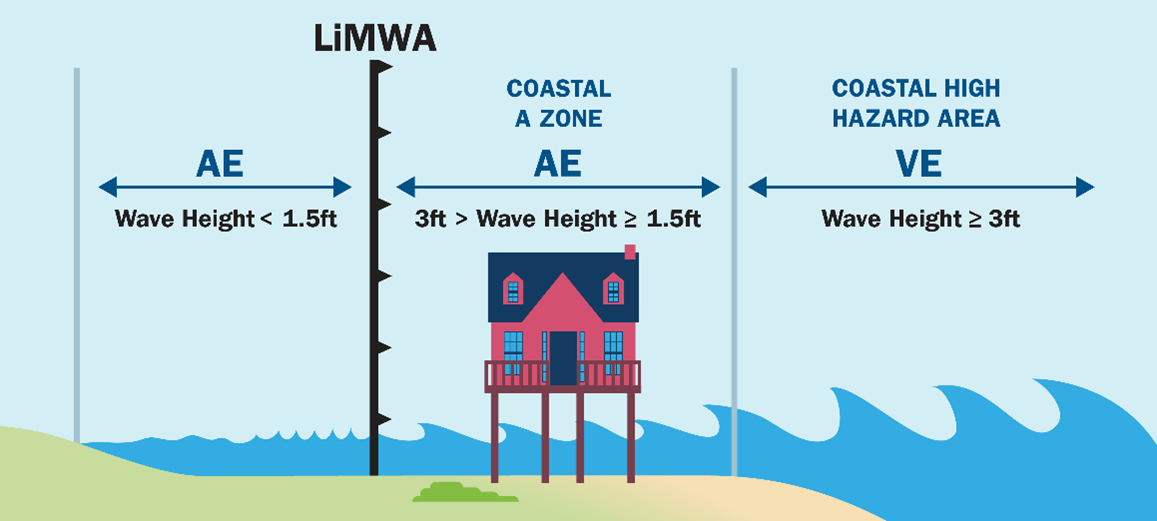

“Coastal A” Zones in Florida were implemented in the 2017 revisions to the Florida Building Code. The Coastal A Zone is an area within a special flood hazard area, landward of a V zone or landward of an open coast. In a Coastal A Zone, the principal source of flooding is astronomical tides, storm surge, seiches or tsunamis. During the flood event, the potential for breaking wave heights is between 1.5 feet and 3.0 feet. Studies have shown that severe damage can occur with breaking wave heights of as low as 1.5 feet, thus the concern and need for the designation of of this new zone, which is a subdivision of the existing A Zone.

“Limit of Moderate Wave Action,” (LiMWA) also implemented in the 2017 revisions to the Florida Building Code, is a line on the Flood Insurance Rate Maps (FIRM) that delineates the inland limit of the 1.5 foot breaking wave height during the flood event. The area seaward of this line up to the Zone VE boundary is the Coastal A Zone (see image below). Despite utilizing Zone A rates for flood insurance premiums, FEMA strongly recommends the higher Zone VE construction standards and floodplain management be utilized in Coastal A Zones, but it is not required. However, local governments are encouraged to implement stricter codes for properties in the Coastal A Zone and incentivized in doing so by the National Flood Insurance Program’s “Community Rating System.” This “CRS” system is designed to award points to local governments participating in the NFIP. The more points a community gets, the greater a discount the residents of that community may be eligible for in their Federal Flood Insurance premium. The more stringent a local governing body’s building code may be, the more points it is likely to get.

“Freeboard” is another means for local governments to garner CRS points. Freeboard is a factor of safety, usually expressed in feet above the minimum Base Flood Elevation (BFE). It refers to the practice of constructing buildings or structures above a certain elevation to mitigate the risks associated with flooding, particularly in coastal areas or regions prone to storm surges and heavy rain, e.g. Coastal A Zoned property. The concept is used to ensure that buildings are not just built at the level of expected floodwaters (i.e. BFE), but are raised higher to account for factors like wave action, erosion, and future increases in flood levels due to climate change. FEMA’s BFE is the starting point, and the local code would require that buildings must be elevated a certain number of feet above the BFE. This extra height is the “freeboard.” These elevated construction standards mitigate risk, thus leading to lower flood insurance premiums.

However, a challenge is presented by way of the surveyor’s elevation certificate. The certificate does not provide the surveyor with an option for the Coastal A Zone, only AE and VE Zones are provided. Therefore, the only BFE options given to the surveyor from the FIRM Map are for VE or AE Zones. If a property is in a Coastal A Zone and subject to VE Zone construction standards, the elevation certificate may not accurately disclose this. Additionally, freeboard requirements associated with the local code are not shown on the FIRM Maps, and therefore, the EC is likely to not disclose any freeboard requirements applicable to the subject property. Thus, a buyer has to be extra cautious to determine what additional building restrictions the local code requires if contemplating new construction or substantial improvement/repair for properties in Coastal A Zones.

If you are working with a client who is interested in purchasing or building in a Coastal A Zone, it is strongly recommended you refer your client to a locally licensed Florida real estate attorney.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan Featherstone, Esq.

rfeatherstone@dunlapmoran.com

As a closing agent, we are in control of funds for the transaction, both in and out. Therefore, as should be expected, we determine when and how deposits and disbursements are made.

Often, we are asked to accept incoming funds by means other than by wire transfer. If this is an initial deposit for a transaction that isn’t closing for three weeks or so, this is likely not an issue. But when it comes to funds needing to be deposited on the day of closing or just prior, the funds must be by wire transfer. But why, you may ask?

First, reviewing the FAR-BAR contracts typically used, paragraph 2(e) states that the balance to close must be by “wire transfer or other ‘Collected’ funds”. Further, Paragraph 18(S) defines the term “Collected” as “any checks tendered or received, including Deposits, having become actually and finally collected and deposited in the account of Escrow Agent or Closing Agent.”

In 2022, FinCEN reported over 680,000 Suspicious Activity Reports (SARs) related to check fraud, which was a record high. According to the U.S. Treasury Department, check fraud has increased by 385% since the pandemic. Additionally, all checks, including personal checks, certified checks and cashier’s checks will have a hold on the funds. The length of the hold depends on the type of check, location where it originated, and the banking institution receiving the check for deposit.

ACH deposits can be reversed for up to 5 business days and can be disputed for up to 90 or even 120 days, depending upon the bank. Therefore, these types of deposits are not reliable and generally all closing agent trust accounts will have blocks on these types of deposits. This includes Zelle, Venmo, CashApp, etc.

Secondly, there are both legal and ethical considerations regarding how money is provided for use in closings. Florida Administrative Code Rule 69O-186.008 states, in pertinent part, “a title insurance agent or title insurer may not disburse funds unless the funds are collected funds. For purposes of this provision, ‘collected funds’ means funds deposited, finally settled and credited to the title insurance agent’s or title insurer’s trust account.”

Additionally, per Florida’s Rules Regulating the Florida Bar, Rule 5-1.1(j), states, “a lawyer generally may not use, endanger, or encumber money held in trust for a client for purposes of carrying out the business of another client without the permission of the owner given after full disclosure of the circumstances…a lawyer may not disburse funds held for a client or on behalf of that client unless the funds held for that client are collected funds. For purposes of this provision, ‘collected funds’ means funds deposited, finally settled, and credited to the lawyer's trust account…a lawyer's disbursement of funds from a trust account in reliance on deposits that are not yet collected funds in any circumstances…when it results in funds of other clients being used, endangered, or encumbered without authorization, may be grounds for a finding of professional misconduct.”

Long story short, unless funds are “collected,” they are not available to use in the transaction and are not secure to be legitimate funds, or incapable of being reversed or clawed back. The only form of funding a transaction that ensures the funds are immediately “collected” upon deposit is by wire transfer. In any other form, the closing agent woule be taking on enormous risk that the funds could be reversed or dishonored, or the closing agent could be violating Florida Bar ethics rules for utilizing other clients’ funds pending the deposit becoming “collected”.

For these reasons, be mindful to guide your clients correctly by setting expectations early on in the transaction that they will need to wire their funds for closing. Of course, we are always available to assist in walking them through the process of wiring funds, and working through our security protocols regarding the delivery of wiring instructions.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

.png)

Authored By: Rachel Reyes-Silva, Esq., rreyes-silva@dunlapmoran.com

Florida's homestead law is a cornerstone of homeowner protection, offering significant benefits and safeguards. If you're a new homeowner or looking to reduce your property tax burden, understanding these laws is crucial. For Realtors, a clear comprehension of these laws is indispensable.

What is Homestead Property?

Florida homestead property is a natural person’s principal residence, which can include up to one-half acre of contiguous land in a municipality or 160 acres in an unincorporated county. All contiguous property is included in the homestead, even if the contiguous property has separate legal descriptions and tax numbers.

What is the Florida Homestead Tax Exemption?

The homestead tax exemption statute, in section 196.031, reduces property taxes by lowering the assessed value of a home by $50,000 ($25,000 as to school district levies) and capping annual increases in the assessed value of the homestead at 3% or the annual Consumer Price Index (CPI), whichever is less. Homeowners must apply for the homestead tax exemption with the county where the property is located.

Who Qualifies for the Homestead Tax Exemption?

To qualify for the homestead tax exemption:

Why is Homestead Protection Important?

Protection Against Forced Sale by Creditors

One of the key benefits provided by Florida’s homestead laws is protection against forced sales by creditors. In the event of a civil judgment, creditors cannot seize the homestead to satisfy debts. However, this safeguard does not encompass all types of liens. While involuntary liens are shielded, voluntary ones such as mortgages, mechanics' liens for home improvements, and tax liens remain enforceable. Homestead protection can be voluntarily waived, typically in mortgage agreements, as a condition of securing financing. Homeowners should understand the implications of waiving homestead protection and seek legal advice before entering such agreements.

Asset Protection and Estate Planning

For asset protection, the homestead exemption automatically applies when the homeowner occupies the property as their permanent residence. However, fulfilling homestead tax exemption requirements entails specific filing procedures. These requirements vary by jurisdiction so homeowners should consult with legal professionals or tax authorities to ensure compliance with relevant regulations and to maximize available benefits.

Even after the homeowner's death, the protection conferred by the homestead exemption remains, serving as a vital component of estate planning. The property is exempt from probate proceedings and cannot be used to settle the deceased's outstanding debts, safeguarding the interests of heirs and beneficiaries.

Homestead Tax Exemption Today

In recent news, Governor DeSantis recently signed a bill to adjust property tax exemptions in Florida annually with inflation. The bill allows for an additional $25,000 property tax exemption which will be adjusted for inflation every year on January 1, based on the annual increase in the Consumer Price Index (CPI), as long as the CPI shows a positive change. This additional homestead tax exemption applies to a homestead's value between $50,000 and $75,000, exempting that amount from all taxes except school district taxes. For example, if CPI increases 5%, the additional benefit will become $25,000 x 5% = $1,250 + $25,000 = $26,250. With the higher exemption amount, homeowners will see a more substantial decrease in their annual property tax bills, providing noticeable financial relief. If approved by voters in November, the bill will take effect on January 1, 2025 as Amendment 5 to the Florida Constitution.

A thorough understanding of Florida's homestead laws empowers Realtors to provide invaluable guidance, safeguarding their clients' most significant investments—their homes. For homeowners, these laws offer essential protections and financial benefits, making it crucial to stay informed and seek professional advice when needed.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan Featherstone, Esq. rfeatherstone@dunlapmoran.com

“You own a residential property? You should put it in an LLC in case of a ‘slip and fall’”. Does this sound familiar? It is a very common conversation amongst investors. And it is often the advice of attorneys.

There is nothing wrong with this advice, but the issue is more complicated than just a limitation of liability. While that is of course a benefit of LLC ownership, among others, there are other considerations that should be factored into the decision of whether to title a property in an LLC.

Loss of Homestead: properties owned in LLCs (or other business entities) cannot be the homestead of the individual owners of the LLC, therefore a transfer of a property into an LLC would result in the loss of a previously obtained homestead tax exemption, or the prevention of the obtaining of a homestead tax exemption, and would also result in the loss of the homestead status of the property for protection from creditors’ claims provided by the Florida constitution.

Reassessment: the change in ownership to an LLC will trigger reassessment of the property for property tax purposes at the fair market value as of January 1 of the year following the transfer of ownership to the LLC. This means that any “caps” on annual assessed value increases (i.e. 3% for homestead property, 10% on non-homestead property) shall be removed, which could result in a significant increase in property taxes for the year after the transfer occurs.

Due on Sale Clauses: every mortgage contains a “due on sale clause,” which of course provides that the mortgage is required to be paid off in the event of a sale of the property, but these clauses also typically include a prohibition on any type of conveyance or transfer, even without a sale, occurring without the lender’s consent. Therefore, a conveyance of a property to an LLC without lender consent could result in a default and the lender calling the note due.

Transfer Taxes: Florida law requires the payment of transfer taxes (i.e. documentary stamp taxes) of $0.70 per $100 of consideration upon a conveyance by deed. This tax is imposed by the Florida Department of Revenue. Under Florida law, even when no money is changing hands, like when moving a property from an individual to an LLC owned by that individual, the law still requires the payment of transfer taxes based on any outstanding mortgage balances applicable to the property. Therefore, for example, if there is a $100,000 mortgage on the property for which a deed is recorded to move the property to an LLC, the transfer taxes owed would be $700. Not a cheap endeavor.

Other Considerations: typically, financing options when residential properties are titled in LLCs tend to be less advantageous (e.g. higher interest rates) than when properties are owned individually, and homeowners’ insurance rates tend to be more favorable for properties owned individually than owned by LLCs. Additionally, annual maintenance is required for LLCs inasmuch as needing to file an annual report every year with the state, paying a filing fee to keep the LLC active, and documenting the LLCs meetings and other events, and to ensure separation of assets of the LLC from individually owned assets to avoid commingling that could result in a potential litigant being able to circumvent the LLC ownership in a lawsuit to get to the individuals.

Keep in mind, there are several potential benefits to owning properties in LLCs which are not covered here. Those would need to be discussed in a separate article. In deciding whether to title a Florida property in an LLC or other business entity, it is always best to consult with a licensed Florida real estate attorney.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan Featherstone, Esq. rfeatherstone@dunlapmoran.com

Below is a summary of 3 recent Florida published cases of note to any real estate practitioner in our state. Please take note of these important cases in your practice!

Real Estate Agency and Agents do not have a statutory duty to investigate unknown defects to properties [Busuttil v. Certified Home Inspections, LLC, et al, No. 1D20-2758 (Fla. 1st DCA, 2021)]

The Seller of a residential property completed a Seller’s Disclosure Form representing that the roof on the home was approximately one (1) year old and came with a transferrable warranty. The home inspector did not observe any issues with the roof during inspection. After closing, it was discovered that the rear of the roof had deteriorated and was older than the front of the house, and that the roof area where there was a leak was part of an unpermitted addition to the house. The real estate agent was named as a defendant in the suit by the Buyer for negligence and misrepresentation. The court ultimately found that while section 475.278, Florida Statutes imposes a duty on the real estate agent to disclose all known facts that materially affect the value of the subject property and are not readily observable, it did not impose a duty to investigate unknown encumbrances or defects. The court declared that if the Legislature intended to include a duty to investigate properties for unknown facts when drafting the law, it could have done so.

Unsigned Emails and Text Messages are not a contract [Walsh III v. Abate, 47 Fla. L. Weekly D702 (Fla. 4th DCA 2022)]

This case involved a lawsuit over a purported contract created by a written offer signed by the Buyer and follow-up emails and text messages amongst the real estate agents involving counteroffer and acceptance language as to purchase price and closing date. After the text messages and emails confirming these terms as to price and closing date, the Seller accepted a different offer from a third party. The plaintiff/buyer filed suit for specific performance based on the initial offer and the confirming text messages and emails, claiming a contract existed. The “statute of frauds” in Florida states that no action shall be brought upon any contract for the sale of lands unless the agreement or promise upon which such action shall be brought, or some note or memorandum thereof, shall be in writing and signed by the party to be charged therewith or by some other person by her or him thereunto lawfully authorized. Section 725.01, Fla. Statutes. The court in this case found that there was no written agreement signed by both parties as required by the statute of frauds. The court stated that dispositively, the Seller did not sign the initial contract/offer, and neither party signed the modification of price and closing date (i.e. the text messages and emails).

Attaching Addendum to Agreement without specifically incorporating it, fails to make it part of the agreement [Mercado v. Sridhar, 48 Fla. L. Weekly D2188 (Fla. 3d DCA 2023)]

This case involved a fully executed contract that contained an addendum prepared by the Buyer and revised by the Seller, but which addendum was never fully executed. The addendum (regarding the home’s furniture and a leaseback option), was not incorporated into the contract in any way, no box in paragraph 19 (Addenda) was checked, and no additional terms relevant to an addendum were identified anywhere in the contract. The Seller argued that there was no contract because the parties had not reached a meeting of the minds regarding the issues contained in the addendum, and that those issues were essential to the formation of the contract. The Buyer argued that the form contract itself contained all the requirements of a contract, was fully executed by the parties, and because the addendum was not incorporated into the form contract, which also contained an integration clause, therefore the form contract constituted the entire agreement between the parties. The court agreed with the Buyer and granted the Buyer summary judgment. The addendum was deemed a separate, distinct, severable form, and collateral to, the form contract. The court found that the mere act of attaching an addendum to the form contract when making the offer/counteroffer was insufficient to make the addendum an essential part of the form contract, such that the addendum’s terms had to be agreed to in order for the form contract to be enforceable.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan Featherstone, Esq. rfeatherstone@dunlapmoran.com

In Florida, we all live on a peninsula, so in one respect we all live on waterfront property. But when you are purchasing or working with clients who may be interested in purchasing property that abuts any body of water, the following is a non-exhaustive list of items to consider prior to making an offer, or during the inspection period provided by the purchase agreement. Of course, this is a simplistic take on each of these issues, but can provide a good checklist for waterfront due diligence.

Riparian Rights / Mean High Water Line

Riparian rights in Florida include the right of ingress, egress, docking, boating, bathing, fishing and other rights defined by Florida law, as well as the right of an upland owner to an unobstructed view of adjoining waters. These rights extend to the “mean high water line” on the abutting waterway, which is the line marking the average height of the high waters over a 19-year period and is the line along the shores of land immediately bordering on navigable waters recognized and declared to be the boundary between the foreshore owned by the state in its sovereign capacity and the upland subject to private ownership. A properly prepared survey will show the mean high water line.

Seawalls

Specific, professional inspections of seawalls are crucial to the purchase of waterfront property that contains a seawall. A defective or delapidated seawall can costs thousands of dollars in damage and devalue a property substantially. Seawall inspections are essential to a comprehensive and diligent inspection of waterfront property, and needed repairs should be negotiated accordingly during the inspection period of the purchase agreement.

Coastal construction control line and other erosion lines

The Coastal Construction Control Line (a/k/a the Coastal Construction Setback Line) places regulatory constraints on construction seaward of the line that provides protection for Florida’s beaches and dunes, while assuring reasonable use of private property. Property may not be modified or constructed seaward of this line without approval from the Florida Department of Environmental Protection. Who Owns Your Beach? Four Lines in the Sand, Feb. 26, 2019, Staff Article, Sanibel-Captiva-Island Reporter, Islander and Current. The Erosion Control Line establishes the boundary of upland ownership by the state when a beach restoration project is constructed. Id. Sand added to the beach seaward of the ECL is owned by the state and held in trust for the public. Id. The ECL is the fixed property line between private and public lands. Id. A landowner does not own this part of the beach in front of the property and the land seaward of this line does not convey with a sale of the adjacent upland parcel. Id. A properly prepared survey will show these lines.

50 percent rule

A full discussion of this topic is well beyond the scope of this blog article. But if your clients intend to remove and replace or significantly remodel the property after closing, it is essential you understand FEMA’s 50% rule. The 50% rule is a regulation of the National Flood Insurance Program that prohibits improvements to a structure exceeding 50% of its market value unless the entire structure is brought into full compliance with current flood regulations. This includes any combination of repair, reconstruction, rehabilitation, addition or other improvements to a building, the cumulative cost of which equals or exceeds 50% of the market value of the building or structure before the improvement or repair is started. And the county or other municipality may have additional rules that apply.

Docks and boat lift inspections

The condition of these items, like any improvements, should be inspected carefully by the appropriately licensed parties, and needed repairs should be negotiated accordingly during the inspection period of the purchase agreement. Also, if no dock exists, but your client would like one, do not assume that one will be permittable solely based on the existence of a dock on a neighbor’s property. This could be a costly mistake. Other issues related to docks to be investigated: (i) rights of replacement in case of damage or destruction of the dock, (ii) third party rights to the dock, and (iii) access rights to the dock.

Base flood elevation and flood insurance

Essentially, Base Flood Elevation (BFE) shows how high water may rise during a 100-year flood (i.e., a flood that has a 1% chance of happening in any given year). Insurance companies compare base flood elevations to the lowest floor of a structure to try and anticipate its chances of experiencing flood damage. This is important for determining flood insurance premiums. If a home’s lowest level is above the area’s BFE, then floodwaters are less likely to reach it, and the insurer may charge a lower rate. All living space and major systems (e.g. plumbing, electrical, HVAC) should be above the BFE. A properly prepared elevation certificate will identify the BFE for the property.

Impact windows

These can reduce insurance rates, and are common practice with new construction, and with condos, many older buildings are upgrading windows to impact ratings at significant cost which results in special assessments accruing to each owner. Often these assessments are missed during the buyer’s due diligence and should always be inquired into, especially in older buildings.

First floor venting

If an enclosed structure in a Special Flood Hazard Area is below the minimum base flood elevation it must have adequate flood venting per the National Flood Insurance Program requirements. Ensuring such venting exists must be determined.

Submerged parcel ownership

Sometimes the seaward land is owned by a third party which could have negative impacts on the usage available (i.e. mooring and navigation). It is vital that a comprehensive title search look at any adjacent seaward parcels to determine potential ownership.

Navigational servitude endorsements/title insurance

Standard title insurance does not cover issues involving riparian rights, and in fact, such rights are an exception to most title insurance policy coverages.

The Navigational Servitude Endorsement provides affirmative coverage against loss or damage suffered by the insured resulting from the forced removal of improvements based upon the U.S. Government exercising its right with respect to its control over navigable waters or lands which were formerly navigable waters because the improvements now constitute an obstruction of the navigable waterways. Consideration of purchasing this insurance (which requires underwriter approval) should be completed prior to closing.

Importance of New Survey and Elevation Certificate

Due to ever-improving technology and equipment associated with surveying property, and the “fluid” nature of waterfront boundaries, it is important to acquire a new survey and elevation certificate, especially for waterfront property. This will ensure the most accurate distances/measurements and whether the property has any gaps between the upland property and the waterfront that might preclude riparian rights of the upland owner. Additionally, most boundary surveys do not include important waterfront lines, like the aforementioned CCCL and the ECL, and without these lines shown, your clients may think they are buying more land in front of the home than they legally are buying, or think they have more room for future construction than they actually do.

Whenever dealing with the purchase or sale of Florida waterfront property, it is always best to seek the guidance of a Florida licensed real estate attorney.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan Featherstone, Esq. rfeatherstone@dunlapmoran.com

Understanding the distinction between the Inspection Period clauses of the two most commonly used contracts (i.e. the FAR-BAR “As Is” and “Standard” Contracts) is vital to your practice. As lawyers, we view every line of any contract as a potential dispute. But nothing is more hotly contested or results in more litigation than the terms of the inspection period. And nothing is more vastly different between the two contracts than this paragraph.

So, let’s dive into this distinction. First, the simpler of the two, the “As Is” contract. In my experience, easily more than 50% of the contracts I see are of this version. I believe the reason for this is because of its inspection period paragraph. It is a simplistic concept, it simply states that during the inspection period (the default provided is 15 days), the buyer is allowed to do any and all inspections of the property and has the right to cancel at any time up to the expiration of the inspection period. In fact, the buyer is not even obligated to do any inspections during this time and can still cancel for any or no reason whatsoever. So, this means the buyer essentially has a “free look” at the property and has a blanket ability to cancel during this period. That is a powerful thing and gives the buyer strong leverage should negotiations be needed for repairs or credits. It also gives buyers comfort that their deposit funds will be protected and refundable should the buyer decide to cancel. It’s important to note here that “As Is” means the seller is not obligated to make repairs and is not warrantying anything. However, this does not relieve the seller of its obligation to disclose to the buyer any and all material facts (especially latent defects) about the property within the seller’s knowledge.

The other version of the contract, what most refer to as the “Standard Contract” has a vastly different inspection period. Quite frankly, it could be talked about over a couple of blogs. Therefore, I’ll keep it basic for these purposes. Essentially, this inspection period requires the buyer to complete inspections before going to the next step (remember, under the As Is contract, the buyer can cancel without even doing inspections). Once inspections are completed, then the contract dictates how things progress from there. Within the contract are 3 pre-negotiated repair limit amounts for 3 categories, as follows: General Repair Items, Wood Destroying Organisms (termites) and Permits. Each of these has a separate amount that is negotiated at the time of the contract. They can end up all being different amounts. For our purposes, let’s assume each category is agreed upon at $2,000. What does this mean?

In my example, if termite issues or permit related matters arise during the inspection period and the cost of remediation of closing out the permits or treating the termites doesn’t exceed the $2000 limits imposed for each, then the seller is obligated to make the repairs/treatment as long as the buyer informs the seller of these issues within the inspection period. This is the same for the General Repair Items notified to the seller during the inspection period. As long as the General Repair Items requested are both covered in the list of items included in the contract and meet the required standard, i.e. the item is not operating in the manner it was designed to operate, and the total requested/covered repairs don’t exceed the repair limit, then the seller is obligated to make the repairs.

However, if any repairs or treatments under the 3 categories exceed their respective repair limits, then it turns to the seller to get the first “bite at the apple.” If the seller agrees to make all the requested repairs, even if they exceed the repair limits, then the buyer remains “locked in” to close, irrespective of the repairs needed, because the seller has agreed to make all the repairs. However, should the seller not agree to make all the repairs, the buyer can either (1) advise the seller which repairs to make, up to the repair limit, and then the buyer accepts all the additional repairs as the buyer’s obligation, or (2) cancel the deal and receive its deposit back.

Ultimately, this section of the contract is significantly more complicated than discussed here, because again, there are 3 categories, each with its own set of rules that apply to how repairs in that particular category are made, and certain deadlines provided for notices, etc., much of which is not covered here. And for the General Repair Items, there are other mechanisms for the seller to dispute the initial buyer’s inspection, which would then result in a second and maybe even third inspection being necessary, along with the costs thereof. But this is well beyond the scope of this article.

If you are tasked with explaining the distinctions between the inspection period clauses of these contracts, or dealing with a dispute over their terms, it is always best to refer your clients to a licensed real estate attorney for explanation and guidance.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Rachel Reyes-Silva, Esq. rreyes-silva@dunlapmoran.com

In the hustle and bustle of the real estate world, Realtors are at the forefront of property transactions. Recognizing the role and relevance of a Power of Attorney (POA) in real estate is vital. As real estate professionals, you are the guides, steering clients through the complexities of property dealings, and recognizing the vital role a POA can play is crucial.

Understanding the Power of Attorney:

A POA is a legal document empowering one individual (the agent) to act on behalf of another (the principal). Under Florida law, the agent can be any individual over 18 or a financial institution that has trust powers, has a place of business in Florida, and is authorized to conduct trust business in Florida. For validity, the POA must:

Depending on you or your client’s specific needs, the type of Florida POA you wish to create will vary. In Florida, you can create the following powers of attorney:

Validity of Out-of-State Powers of Attorney:

If an out-of-state power of attorney and its execution were valid in another state, it is also valid in Florida. It is extremely important to note, however, if a power of attorney is used to convey real property, it must be executed in the same manner as a deed- i.e. two witnesses and a notarized acknowledgement- even if not required in the state of execution. A third party who is called upon to accept an out-of-state power of attorney may request an opinion of counsel from the state of execution concerning the power’s validity in that state, at the principal’s expense. This underscores the utmost importance of timely communication when utilizing a POA in real estate transactions.

Using Powers of Attorney in Real Estate Transactions:

Real estate transactions involve various stages, and at each step, signatures on contracts and legal documents are crucial. Both buyers and sellers can use an agent through a POA, streamlining the process. Typically, a photocopy of an original POA has the same effect as the original, BUT keep in mind that an original POA that is relied upon to affect title to real property is almost always required for recording in the original records. Communication is key so any intent to use a POA for a real estate transaction should always be expressed early on to address objections promptly.

In the dynamic realm of Florida real estate, a well-utilized Power of Attorney (POA) can streamline transactions and provide flexibility for your clients. The key lies in timely communication of the intent to use a POA and addressing potential objections as soon as possible to ensure a smooth process. If you believe you may need to utilize a POA, it is best to consult with an attorney to navigate the complexities and make informed decisions that best suit your client.

see Chapter 709, Florida Statutes for more information

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

.png)

Authored By: Ryan A. Featherstone, Esq. rfeatherstone@dunlapmoran.com

Just a few short months ago settlement agents in Florida became obligated by the Florida government to obtain an affidavit from each and every Buyer we work with attesting to the fact that he/she is not a foreign principal of a certain seven (7) listed countries, and if a Buyer is such a foreign principal, additional analysis applies to determine if the transaction can even proceed. This has proven to be a large burden on settlement agents and Realtors. The hope was that this would be the last change in the closing industry for some time related to required due diligence involving the parties to a transaction. However, as of October 22, 2023, we have yet additional red tape to deal with, this time coming from the Federal government.

Effective October 22, 2023, the Financial Crimes Enforcement Network (FinCEN) of the U.S. Department of the Treasury issued a new Geographic Targeting Order (GTO) that incorporates certain real estate transactions for properties located in Sarasota and Manatee Counties. For the applicable transactions, new reporting requirements through FinCEN’s online portal will need to be followed after the transaction closes, with certain information about the transaction and the buyer(s) required to be uploaded.

Transactions that meet ALL the following parameters are now subject to the GTO, resulting in additional reporting requirements to FinCEN:

1) Purchase of residential property (1-to-4 family), including condominiums and co-ops; and

2) Purchase completed between November 21, 2023 through April 18, 2024 (NOTE: the GTO will likely be extended); and

3) Purchase price of $300,000 or more; and

4) Buyer is a legal business entity (e.g. LLC, corporation, partnership) EXCEPT for (1) a business listed on a securities exchange regulated by the Securities Exchange Commission (SEC); or (2) a self-regulatory organization registered with the SEC, or an entity solely owned by such a business; and

5) Purchase is made without a bank loan or other similar form of institutional financing (i.e. cash deals); and

6) Buyer essentially uses any conventional form of funding of the transaction (e.g. wire, certified check, cashier’s check, etc.).

Settlement agents are also required to store this information themselves for five (5) years from the last day that the GTO is effective (including any renewals thereof), however as stated above, the renewals will likely continue indefinitely.

Therefore, we have yet another burden imposed upon settlement agents for both the collection and storage of the required information, as well as the correct reporting of the information to FinCEN, along with any responses from FinCEN that will have to be dealt with. As this plays out, it is possible that settlement agents handling affected transactions may charge some additional fees at closing due to the extra time involved in dealing with this governmental red tape.

If you happen to be working on any transactions that may be subject to the new GTO, be sure that you and your clients speak with a Florida licensed real estate attorney.

.jpeg)

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Scott W. Dunlap, Esq. sdunlap@dunlapmoran.com

Lady Bird deeds (or what more formally are known as enhanced life estate deeds), are now approved for use in the state of Florida. Several other states as well have approved use of this type of deed. In order to understand the unique and beneficial qualities of a Lady Bird deed, it is first necessary to understand the traditional life estate deed.

With a traditional life estate deed, the owner of the real property reserves the right to live and enjoy the property until the owner’s death, at which time the property automatically passes to the beneficiary named in the deed (the remainderman). The primary drawback to the traditional life estate, is that the life estate grantor can only sell or mortgage the subject property with the consent of the remainderman/ beneficiary.

The Lady Bird deed is similar to a traditional to a life estate deed, in that the owner is in essence conveying a future interest in the property during the owner’s lifetime. However, with the use of a Lady Bird deed the owner may sell, use and mortgage the property during the owner’s lifetime without the consent of any of the beneficiaries/ remaindermen named under the Lady Bird deed. The Lady Bird deed is also, typically “tax neutral” during the owner’s lifetime, as there is no gift or other transfer of title until the grantor passes away, and then only in the event that the property is still owned by the grantor at the date of death.

Under current Florida law, the transfer of title to the beneficiary named in the Lady Bird deed, once the owner passes, is a transfer occurring outside of probate. The use of a Lady Bird deed can be used, therefore, as an estate planning tool and in some cases it may be more cost effective than utilizing a living trust or revocable trust.

Care must be taken to properly draft a Lady Bird deed, so as to ensure the provisions required for the Lady Bird deed are in fact contained in the deed. Care must also be taken in the event that the beneficiary or remainderman named in the deed predeceases the owner. Similarly, multiple remaindermen/ beneficiaries named in the deed may complicate things. Some lenders may be reluctant to make mortgage loans secured by property subject to a Lady Bird deed, given that the lender may not understand that the beneficiary’s interest is non-vested.

In sum, the use of a Lady Bird deed can be a useful and cost-effective tool in the state of Florida.

Any time you are involved in a transaction where the parties are discussing the use of a Lady Bird Deed, be sure to contact a Florida licensed real estate attorney to assist.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan A. Featherstone, Esq. rfeatherstone@dunlapmoran.com

As we are all aware, since July 1, 2017, fees for the preparation and delivery of estoppel certificates from condominiums, cooperatives and homeowners’ associations have been capped per Florida Statute at $250 for standard delivery (within 10 business days), and an additional $100 for rush fees (within 3 business days).

However, the statutes require that the fees be adjusted every 5 years in an amount equal to the total of the annual increases for that 5-year period in the Consumer Price Index for All Urban Consumers, U.S. City Average, All Items. The statutes further provide that the Department of Business and Professional Regulation (DBPR) shall periodically calculate the fees, rounded to the nearest dollar, and publish the amounts, as adjusted, on its website.

In accordance with its statutory duties, the DBPR has revised the authorized fees for estoppel certificates effective July 1, 2022. The new fees are provided below. The next published update will be released July 1, 2027.

Updated Fee Schedule:

1) Preparation and delivery of estoppel certificate

Fee: not more than $299

*$250 prior to 7/1/22

2) Rush estoppel (within 3 business days)

Fee: an additional $119

*$100 prior to 7/1/22

3) If the unit/parcel is delinquent to the association

Fee: an additional $179

*$150 prior to 7/1/22

** Different fees apply if the seller is selling multiple units/parcels subject to the same association (see Section 720.30851, Florida Statutes for more information)

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan A. Featherstone, Esq. rfeatherstone@dunlapmoran.com

In this current crazy market a very hot topic is leaseback agreements where sellers lease back their properties from their buyers after closing. This appears to be happening mostly because sellers are, understandably, rushing to sell at the height of the market, but are doing so in many cases without any real relocation plan. They are finding the purchase market or rental market is very competitive, leaving them with a serious challenge as to where to go after closing.

A short-term solution for this coming up on a regular basis is the leaseback. But these deals can be fraught with problems. The following presents some of the more commonly overlooked pitfalls that can arise in a leaseback situation.

1) The Post-Closing Occupancy Rider: this is the document typically used when this topic arises while negotiating the contract. We often find that the parties to the transaction believe that this itself is the leaseback agreement. In fact, this document is only a contingency, providing that a further agreement must be drafted and mutually agreed to by the parties no less than 10 days prior to closing, otherwise either party can cancel the transaction by written notice. Therefore, this can actually be dangerous if the leaseback agreement isn’t timely drafted and agreed to, as it could result in a cancelled closing. Furthermore, this document only provides for two of the terms of the leaseback agreement, its length, and the rental amount. That’s it. It doesn’t provide for any of the other essential terms, which will be addressed in the next section.

2) The Leaseback Agreement: the rider discussed above only provides for the length of the leaseback and the rental amount, and that’s if those sections are even filled in, and we often find that these are left blank. A leaseback agreement is a short term lease, and as such, should contain all material terms of a standard lease. Namely, length, rental amount, security deposit, utilities responsibility, maintenance and repair responsibility, services responsibility (e.g. pool, lawn, pest), HOA or condo dues responsibility, rental insurance, pet restrictions, risk of loss, extension options, and hold harmless indemnification, among other topics. Most times, none of these items have been discussed or even considered for discussion, which can lead to disagreements later.

3) Lender Restrictions: this particular issue is coming up more and more often and lending underwriters are getting ever more strict on this topic due to the prevalence of leasebacks in this current market. Any primary residence loans that need to meet Fannie Mae, Freddie Mac or FHA underwriting guidelines will mandate that the buyer occupy/possess the property within 60 days of closing. Thus any leaseback term cannot exceed this timeframe, including any extensions. This is a hard-and-fast rule, however it must be noted that some lenders have “overlays” that might limit the term further, to as little as 45 or 30 days. It’s is very important to determine the buyer’s chosen lender’s leaseback term restrictions before going under contract. A note about second homes: while the concept of extending beyond 60 days may not itself violate a rule, from a practical perspective, any leaseback longer than that will likely involve a rent payment obligation and this will violate underwriting rules as that will result in the leaseback making the property into an “income-producing” property which won’t be allowed by underwriting. We have had many deals lately involving leaseback periods of 90 days or longer, which has been very problematic as the sellers in such situations absolutely could not get out within 60 days. This has caused disputes amongst the parties or expensive consequences, like delaying closing for a period of time to allow the 60 day restriction to be met, resulting in costly mortgage rate lock extensions and attorney’s fees for resolving the disputes.

4) Sales Tax: Florida law provides that any lease period of less than 6 months is subject to sales tax and “tourist development tax” based off the rental amount. This is at the state level (6% sales tax) and the local level [depends on county (Sarasota and Manatee County = 1% sales tax)] plus the tourist development tax [also depends on the county (Sarasota and Manatee = 5%)]. Taken together this is 12% or higher! Additionally, this must be remitted appropriately to both the state and county and the paperwork to register as a taxpayer and remit is fairly complicated.

5) Landlord-Tenant Law and Covid-19: regardless of what you call the arrangement or title the agreement itself, it is a lease, and will be subject to Florida landlord-tenant law. Thus, any rules that apply, like eviction legal procedures, will apply to the leaseback. If the seller refuses to vacate at the end of the leaseback term, the only remedy available to the buyer is eviction. Evictions can be costly and time consuming and can be directly impacted by federal, state or local Covid related moratoriums.

Leasebacks can be a good solution in this current climate, but as often occurs, the “simple” solution ends up being much more complicated than anyone expected. It is essential you keep these issues in mind when negotiating a contract that is to be subject to a leaseback. Any time you are involved in a transaction where the parties are negotiating a leaseback agreement, be sure to contact a Florida licensed real estate attorney to assist.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan A. Featherstone, Esq. rfeatherstone@dunlapmoran.com

Does the following sound familiar? You’ve been selling residential real estate for years, and you suddenly get a hot lead on a commercial property and you have the perfect buyer for it. Or perhaps client calls and says he wants you to show him some commercial property. You think to yourself, “I haven’t done commercial real estate deals before, but how different could it be?” Answer: Very!

The distinctions between commercial real estate and residential real estate transactions are abundant, and go well beyond the scope of a blog article. The below is meant to only highlight some of the more common differences and issues that may arise in commercial transactions versus residential transactions. My recommendation is to always bring on an experienced commercial agent to work with you on the deal, or alternatively refer the matter to the commercial agent and take the referral fee.

Valuation challenges: Locating “comps” can be more difficult in commercial deals due to the uniqueness of many commercial properties as well as the differing uses by the commercial businesses/tenants. Residential properties are much more uniform, with some exceptions, and the use is always consistent, i.e. it is a residence. There are also different approaches to appraising commercial property: e.g. “CAP” rates, income versus cost versus sales approach. The use of appraisers in determining value “pre-contract” is much more common in commercial deals.

Zoning complexities: Residential usage is a given in residential zoning districts. However, this is not as certain in commercial property deals, where specific usage and intent of the client must be verified as an allowed use within the district. As with residential property, there may be times when a certain usage or property attribute would violate current zoning laws. A review of the zoning history is needed to determine if you have a “legally non-conforming” (i.e. “grandfathered”) use or property attribute (e.g. setbacks or base flood elevation), and to determine how a sale (or buyer’s intended plans thereafter) may affect such grandfathering. This also needs to be verified in cases of planned redevelopment, as new improvements need to be built in compliance with current zoning laws.

Due Diligence concerns: The residential form contracts are very standardized, and allow for broad inspections during the defined inspection period with differing rights as to cancellation and repair requests. In commercial deals, the contract is often attorney-prepared; and therefore, it may be heavily in favor of one party over the other. Commercial properties and their use vary greatly; therefore, the due diligence required can also vary greatly. Many different inspections may be required during this timeframe. Residential properties typically involve general inspections, 4 point inspections, wind mitigation, and termite inspections. Commercial properties often involve additional inspections, e.g., environmental inspections (i.e. Phase I and Phase II), asbestos, or engineering and architectural inspections. Extra caution needs to be taken in inspecting commercial property. It is not uncommon that a commercial property was used for the storage of hazardous substances; therefore, an environmental soil and groundwater inspection may be necessary.

Financing: Residential properties have several commonly known options: Conventional, FHA, VA, USDA, seller-financing, private financing. Commercial properties have several other options, including: short term loans, interest-only, fixed rate, variable rate (tied to any number of indices), SBA loans (most common 7(a) and 504), business credit lines, equipment loans, blanket asset loans, cross-collateralization, or bridge loans. Collateral other than the real estate will often be taken by the lender, including UCC liens on business assets (e.g. furniture, fixtures, and equipment, other tangible assets, inventory, receivables, bank accounts). The client will also be required to sign an Assignment of Leases, Rents and Profits, assigning to the lender the rental income and other profits from the property in case of a default, along with a personal guaranty of the loan, as most often in commercial deals the purchaser/borrower is some form of business entity.

Lease Matters: In residential deals, usually the property is going to be owner-occupied, as a primary residence or second home. However, in commercial property deals, more often the property is leased, and therefore additional considerations must be taken into account. Careful review of the leases, rent roll, tenant estoppels, and confirmation of prepaid rents and deposits is always necessary to adequately review the profitability and cash flow of the property. Ensuring the tenant signs an agreement subordinating the lease to the mortgage prior to closing is important. This states that the lease is subordinate to the commercial mortgage (despite being prior in time to the mortgage), that the tenant shall not be disturbed by the lender as long as it is not in default of the lease, and that the tenant agrees to “attorn” to the lender and accept the lender as the new landlord in the case of a foreclosure or deed in lieu of foreclosure.

Other Miscellaneous Matters: Potential “impact Fees” should be reviewed for new development or redevelopment to determine if the property acquisition makes sense for the client. These are often overlooked costs charged by local government to the property owner for offsetting costs of additional public services necessary for the development/redevelopment and other impacts to the surrounding area. “Complex access issues,” are another common commercial property related issue, for example, an out parcel property in a larger strip center. Does the out parcel have legal access and/or cross-easements over the strip center parcel? Does the outparcel have its own assigned parking? If not, easements will need to be negotiated, drafted and recorded. “Common Area Maintenance” (i.e. CAM) must be determined prior to closing for an adequate review of all costs associated with ownership. This may be passed onto the tenant(s) to pay in a net lease scenario, thus knowing what a potential tenant’s expectations are during due diligence is essential. Finally, the “Commercial Real Estate Sales Commission Lien Act” which provides that in commercial deals, brokers have the right to impose a lien on the seller’s net proceeds (not the property itself) to protect the payment of their commissions. This does not exist in residential deals.

If you ever find yourself deciding whether to take on a commercial real estate deal, it is always recommended to involve the services of a licensed Florida real estate attorney, and the services of an experienced commercial real estate agent, to help you navigate the murky waters of commercial real estate transactions.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan A. Featherstone, Esq. rfeatherstone@dunlapmoran.com

Most real estate professionals have had a transaction affected by these rights in some capacity, commonly referred to as oil, gas and mineral rights (“OGM”). Florida courts have held that these rights are superior to the rights of the surface owner. Some national developers/builders include the OGM reservation in their deeds, as a matter of course. In certain areas of the state, OGM rights were reserved by and remain with the original families that developed the area, e.g. Barron Collier (Lee and Collier counties). These rights will be exceptions to title insurance coverage, and losses incurred as a result of enforcement of these rights are not covered by the standard title policies. Coverage can sometimes be available by endorsement to the policy, but only if the right of entry is not reserved.

Historically, the issue comes up from land that was at one time conveyed by the state, most commonly by the Trustees of the Internal Improvement Fund (“TIIF”). Much of the state’s land came to it from the Depression, when owners had trouble paying their real estate taxes and thus lost their property to the state. It is noteworthy that when state and local government entities convey title into private hands, the OGM reservations are automatic, even if not specified in the deeds. However, “since 1986, the rights of entry that accompany the OGM reservations were automatically lifted from both TIIF and State Board of Education deeds as to parcels of property that are, or ever have been, a contiguous tract of less than 20 acres in the aggregate under one ownership.” Fund Concept Article Nov. 2019. This release of the right of entry is codified in Florida Statutes Section 270.11.

But what does this all really mean? And how could it impact your future deals?

For the most part, mortgage lenders, buyers, and title insurers focus on the right of entry relative to the OGM rights. If the owner/holder of the OGM rights also holds a right of entry onto the land, obviously this could be significantly disruptive and potentially damaging to the land and property, not to mention its value and marketability. If the right of entry has been released, then most of the time, the lenders, buyers and title insurers feel confident in moving forward without having to secure a release of the OGM rights, which may be impossible to get anyway. The Florida form contracts state that OGM rights that include the right of entry are a title defect that has to be cured by the seller. Of course, this requires a title objection from the Buyer, so as a relevant aside, this is yet another reason why you should always close deals with an attorney and not a non-attorney title company. There are several approaches and/or analyses that can be used to try and eliminate the right of entry depending on the facts, e.g. the Marketable Record Title Act, Ch. 712, Florida Statutes (MRTA) or requested releases from TIIF or the Department of Environmental Protection.

Now, is it possible there is a situation where the right of entry is released yet a neighboring property is used to excavate the subsurface materials a la Daniel Day Lewis in the movie “There Will Be Blood”? Yes, of course, especially with today’s drilling technology. But from a practical standpoint, the risk is fairly low, again, making the buyer, lender and title insurer comfortable with moving forward without the concern of damage to the property or negative impact on its marketability. Additionally, zoning regulations may prevent extraction; however zoning laws can change so they should not be solely relied upon to resolve the issue.

In a perfect world, OGM rights would be released on every property for which they are reserved. But there is no guarantee the owner/holder would agree to the release (at a minimum without compensation) and in many cases it may be extremely difficult if not impossible to locate the owner/holder or heirs, resulting in expensive “quiet title” litigation or otherwise. For residential properties, such lengths are usually not necessary as long as the right of entry has been released by instrument or by law. However, for larger commercial projects or large acreage deals, the reservation itself could be concerning, requiring extra effort and expense to have the OGM rights released or sold prior to purchase or development. And on those deals, where customized purchase and sale contracts are common, extra attention should be paid to ensure that the reservation of OGM rights (or at a minimum the right of entry) is in fact a title defect protecting the buyer’s deposit should they not be capable of being released.

Whenever working on a transaction where OGM rights have been reserved, it is bets to consult a licensed Florida real estate attorney for an analysis of the potential impacts this may have on your transaction to ensure your client is protected.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Scott W. Dunlap, Esq. sdunlap@dunlapmoran.com

For those of you who already have the homestead tax exemption on your primary Florida residence, you may have recently received a yearly receipt card for the exemption renewal.

As a reminder, the renewal card provides, in part, that your homestead exemption will be automatically renewed without any further action if the property is still the taxpayer’s primary residence. Common examples of the property no longer qualifying as a primary residence include the renting of the property, property owner moving to another residence or to an assisted living facility, or the property owner benefitting from a residency-based exemption in another state (the “Trap”).

The Trap, which was the subject of a recent Sarasota County lawsuit, relates to Section 196.031(5), Florida Statutes, which provides, in part, that a person who is receiving or claiming the benefit of an ad valorem tax exemption or tax credit in another state, where permanent residency is required as a basis for such exemption, is not entitled to the Florida homestead exemption. This provision is a trap for the unwary, as the recent case in Sarasota County involved a couple from Ohio, who never even applied for such exemption on their Ohio home, and had no knowledge that the permanent residency-based exemption for their Ohio home even existed. The Sarasota County Property Appraiser became aware of the fact, and revoked the Florida homestead exemption, and exacted various penalties, back taxes and interest. The benefit that was received in Ohio was in the neighborhood of $500.00, but the back taxes, penalties, and the like collected in the lawsuit in Sarasota County, was in excess of $10,000.00!

The result in the above-referenced case was very harsh, and the court recognized this fact. Based on the case and similar cases, the Florida Legislature is considering modifying the homestead statute to provide that the aggrieved person or family has a chance to demonstrate to the property appraiser that the person or family did not apply for the exemption or credit and that upon becoming aware, the person or family has relinquished the exemption or credit in the other state. Said law may or may not pass.

In summary, if you are entitled to the homestead exemption, by all means timely apply for and claim this valuable Florida benefit. However, if you later are no longer entitled to the exemption, you must notify the local property appraiser, as there are severe penalties that can apply if the homestead exemption is renewed but the property owner does not qualify for the continuance of the homestead exemption. Note that not all counties mail a homestead renewal notice, so this may require the owner to be even more proactive. And in particular if you are a new Florida resident, make doubly sure that you are not receiving any sort of homestead exemption or exemption based on permanent residency in your prior state of residency, so that you avoid the Trap.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan A. Featherstone, Esq. rfeatherstone@dunlapmoran.com

We frequently handle closings that involve a lease or tenancy, and more often than not, we are not informed that the property is occupied by a tenant. This can lead to numerous issues during the closing process. With the exception of some foreclosure scenarios, any property that is sold with a tenant occupying the property is sold subject to the tenancy. This could be whatever term remains under a lease, or it could be a month-to-month tenancy. However, regardless of the situation, the simple fact that the property is changing ownership does not alone provide the buyer with any right to remove a tenant.

Paragraphs 6 and 18D of the FAR-BAR contracts address rented properties, and whenever a tenant is occupying a property and will remain for any period of time after closing, the box in paragraph 6 should be checked. This should also be disclosed to prospective buyers by the seller in advance of any offers, and the MLS listing should reflect the property is currently occupied by a tenant.

These paragraphs should be reviewed carefully. Collectively, they obligate the seller to provide the following to a buyer: (1) copies of any lease(s) and (2) estoppel letters from the tenant(s), or a seller affidavit. The buyer has expiring cancellation rights that commence from the delivery of each of these items, so for a seller, it is imperative to provide this information as timely as possible. Estoppel letters from the tenant(s) are documents that specify the nature and duration of occupancy, rental rates, and advanced rent and security deposit amounts. This is so the buyer can cross-reference the lease and other information provided by the seller with the information provided by the tenant(s), to ensure accuracy and have the opportunity to question any discrepancies. Items like prorated rent and transferring of security deposits and prepaid rents must be correctly handled at closing, so dealing with discrepancies is crucial to an accurate closing.

But as with most things in real estate, what the contract states is merely the beginning. The following is a discussion of some of the more common (and overlooked) issues when dealing with rented properties.

If the ongoing tenancy is month-to-month, like in cases where a lease term has expired, and the buyer wants the tenant to continue to rent the property after closing, then the tenant needs to sign a new lease with the buyer. If the buyer wants the tenant to vacate the premises, then the buyer/new owner should provide the tenant with a notice to vacate. For month-to-month rentals, Florida law requires a fifteen (15) day notice be given to the tenant prior to the next rent payment being due. If this notice is not given until the buyer closes the transaction, then there is no way to know if the tenant plans on “holding over” after the notice period expires, requiring an eviction be filed. This is a risk to the buyer, and ideally the notice would be done before the closing takes place.

However, if the lease has not yet expired, then there must be an assignment of lease prepared and executed at or before closing. This is essential for the buyer so that the buyer receives all the rights the seller had under the lease, most importantly, the right to receive the rent and evict the tenant in the case of non-payment of rent.

Next, if the seller is using a rental agent for the collection of rents, and the buyer plans to continue renting the property after closing, does the buyer plan to use that same rental agent? If not, then the rental management agreement needs careful review to determine what the termination provisions state, as many times lengthy notice must be provided to terminate the rental management agreement. Additionally, even after termination, the rental agent may still be entitled to a commission if they were responsible for placing the tenant. Conversely, if the buyer plans to continue using the rental agent after closing, a new agreement with the rental agent should be executed, or at a minimum, the pre-existing one with the seller should be assigned to the buyer.

Is the rental agent holding any security deposits or prepaid rents? If so, then it needs to be confirmed that these will be transferred over by the agent to the account of the buyer after closing, and not disbursed to the seller. This is especially important if the buyer does not plan to use the rental agent after closing. Another question is whether the rental agent has disbursed any rents to the seller for the month of closing. For example, if the closing occurs on the 15th of the month, presumably the rent has been paid by the tenant. If the rental agent has disbursed the rent to the seller (less the rental agent’s commission), then appropriate prorating of the rent on the closing statement is necessary to ensure the buyer receives from the seller the rental credit from the date of closing through the end of the month.

Next, if the buyer is obtaining a mortgage for the purchase of the property, what impact might the tenancy have on eligibility? For example, most primary residence mortgages require that the buyer occupy the property as their residence shortly after closing. Typically, there is an “Occupancy Affidavit” signed at closing by the buyer attesting, under oath, to the fact that the buyer will actually occupy the property no later than sixty (60) days after the closing. Obviously, if the tenancy expires more than sixty (60) days after closing, the buyer would be lying when signing this affidavit. Additionally, the rental usage could impact a buyer’s eligibility even for a second home loan. When dealing with a rented property, these issues need to be addressed as soon as possible with the loan officer for the mortgage.

Another concern is related to insurance. What impact might the rental have on homeowner’s insurance availability and rates? If the tenancy expires after closing, the insurance companies will likely require the buyer to purchase a DP-3 policy (insurance for rental properties) versus an HO-3 policy (insurance for primary residences). The coverage is different, as is the cost, with DP-3 policies typically being more expensive. Once the buyer moves in, the policy can be converted to an HO-3 policy, but this is a hassle for the buyer and something that can cause delays to closing.

An additional major concern, which currently is a hot topic with the advent of Airbnb and VRBO type services, is the legality of short-term rental usage of a property. Many buyers are wooed into purchasing a property with the promise of substantial income from vacation/short-term rentals. In most cases, the seller can provide legitimate evidence of the income-producing history. However, zoning restrictions do not typically allow for short-term rentals in most local areas. When this is explained, we often hear the response “but everyone in that area is doing it.” This is where we should all hear our parents saying, “if all your friends were jumping off a bridge, would you jump too?” Just because others are doing it, doesn’t make it right, or in this case, legal. In fact, properties that are off the “barrier islands” cannot be rented for periods less than thirty (30) days. The seller may have been renting the property for shorter periods, but not legally, and there can be no guarantee such use will continue, as governmental offices are cracking down on these violations. Of course, this is a separate issue from whether the short-term rentals violate any applicable homeowners association or condo association rules against short-term rentals.

Lastly, note that a rented property will not be exempt from IRS reporting at closing. Therefore, the seller will be receiving a 1099-S (Sale of Real Estate) at the closing table and should anticipate this prior to closing. The seller should consult with the seller’s accountant relative to any capital gain taxes that might be due on the sale of a property that is subject to a tenancy.

Naturally, there are additional concerns with rental properties not covered here. Whenever dealing with a property that is currently being rented and will remain so after closing, for whatever period of time, we recommend that you consult with a licensed Florida real estate attorney to discuss all of the potential pitfalls to you and your client that might be overlooked.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Scott W. Dunlap, Esq. November is here, and hopefully cooler weather is on the way. Thanksgiving is also approaching. And of course, real estate tax bills have now been made available... More »

Authored By: Ryan A. Featherstone, Esq. As real estate professionals, we have all had a transaction or two that have been affected by permit-related issues. Whether it was an open permit, an expired... More »

Authored By: Benjamin DeMarsh, Esq. and Ryan Featherstone, Esq. Sarasota County plans to adopt a new ordinance (No. 2019-024) that amends the Sarasota County Unified Development Code and expands... More »