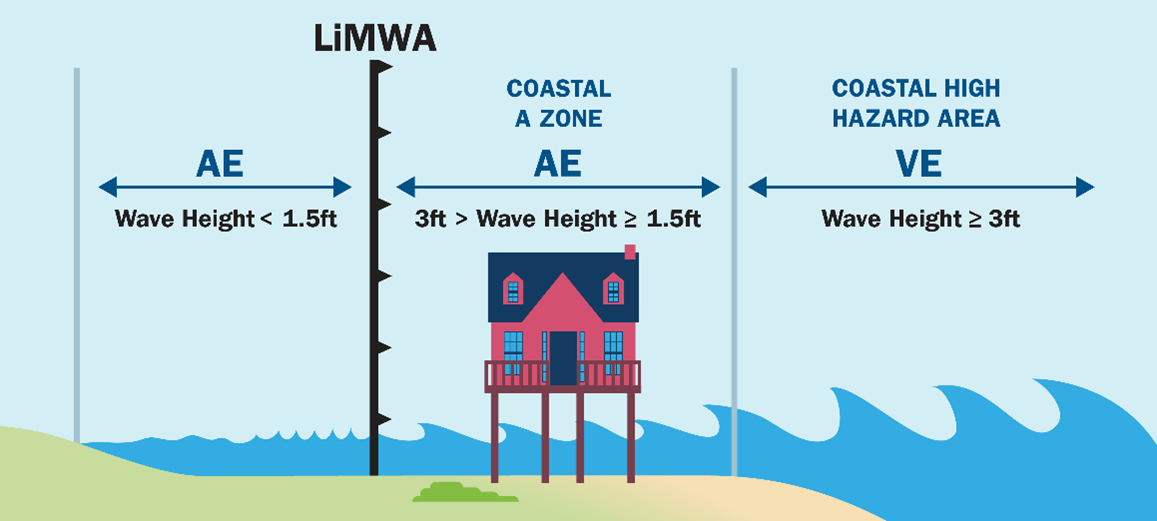

“Coastal A” Zones in Florida were implemented in the 2017 revisions to the Florida Building Code. The Coastal A Zone is an area within a special flood hazard area, landward of a V zone or landward of an open coast. In a Coastal A Zone, the principal source of flooding is astronomical tides, storm surge, seiches or tsunamis. During the flood event, the potential for breaking wave heights is between 1.5 feet and 3.0 feet. Studies have shown that severe damage can occur with breaking wave heights of as low as 1.5 feet, thus the concern and need for the designation of of this new zone, which is a subdivision of the existing A Zone.

“Limit of Moderate Wave Action,” (LiMWA) also implemented in the 2017 revisions to the Florida Building Code, is a line on the Flood Insurance Rate Maps (FIRM) that delineates the inland limit of the 1.5 foot breaking wave height during the flood event. The area seaward of this line up to the Zone VE boundary is the Coastal A Zone (see image below). Despite utilizing Zone A rates for flood insurance premiums, FEMA strongly recommends the higher Zone VE construction standards and floodplain management be utilized in Coastal A Zones, but it is not required. However, local governments are encouraged to implement stricter codes for properties in the Coastal A Zone and incentivized in doing so by the National Flood Insurance Program’s “Community Rating System.” This “CRS” system is designed to award points to local governments participating in the NFIP. The more points a community gets, the greater a discount the residents of that community may be eligible for in their Federal Flood Insurance premium. The more stringent a local governing body’s building code may be, the more points it is likely to get.

“Freeboard” is another means for local governments to garner CRS points. Freeboard is a factor of safety, usually expressed in feet above the minimum Base Flood Elevation (BFE). It refers to the practice of constructing buildings or structures above a certain elevation to mitigate the risks associated with flooding, particularly in coastal areas or regions prone to storm surges and heavy rain, e.g. Coastal A Zoned property. The concept is used to ensure that buildings are not just built at the level of expected floodwaters (i.e. BFE), but are raised higher to account for factors like wave action, erosion, and future increases in flood levels due to climate change. FEMA’s BFE is the starting point, and the local code would require that buildings must be elevated a certain number of feet above the BFE. This extra height is the “freeboard.” These elevated construction standards mitigate risk, thus leading to lower flood insurance premiums.

However, a challenge is presented by way of the surveyor’s elevation certificate. The certificate does not provide the surveyor with an option for the Coastal A Zone, only AE and VE Zones are provided. Therefore, the only BFE options given to the surveyor from the FIRM Map are for VE or AE Zones. If a property is in a Coastal A Zone and subject to VE Zone construction standards, the elevation certificate may not accurately disclose this. Additionally, freeboard requirements associated with the local code are not shown on the FIRM Maps, and therefore, the EC is likely to not disclose any freeboard requirements applicable to the subject property. Thus, a buyer has to be extra cautious to determine what additional building restrictions the local code requires if contemplating new construction or substantial improvement/repair for properties in Coastal A Zones.

If you are working with a client who is interested in purchasing or building in a Coastal A Zone, it is strongly recommended you refer your client to a locally licensed Florida real estate attorney.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.

Authored By: Ryan Featherstone, Esq.

rfeatherstone@dunlapmoran.com

As a closing agent, we are in control of funds for the transaction, both in and out. Therefore, as should be expected, we determine when and how deposits and disbursements are made.

Often, we are asked to accept incoming funds by means other than by wire transfer. If this is an initial deposit for a transaction that isn’t closing for three weeks or so, this is likely not an issue. But when it comes to funds needing to be deposited on the day of closing or just prior, the funds must be by wire transfer. But why, you may ask?

First, reviewing the FAR-BAR contracts typically used, paragraph 2(e) states that the balance to close must be by “wire transfer or other ‘Collected’ funds”. Further, Paragraph 18(S) defines the term “Collected” as “any checks tendered or received, including Deposits, having become actually and finally collected and deposited in the account of Escrow Agent or Closing Agent.”

In 2022, FinCEN reported over 680,000 Suspicious Activity Reports (SARs) related to check fraud, which was a record high. According to the U.S. Treasury Department, check fraud has increased by 385% since the pandemic. Additionally, all checks, including personal checks, certified checks and cashier’s checks will have a hold on the funds. The length of the hold depends on the type of check, location where it originated, and the banking institution receiving the check for deposit.

ACH deposits can be reversed for up to 5 business days and can be disputed for up to 90 or even 120 days, depending upon the bank. Therefore, these types of deposits are not reliable and generally all closing agent trust accounts will have blocks on these types of deposits. This includes Zelle, Venmo, CashApp, etc.

Secondly, there are both legal and ethical considerations regarding how money is provided for use in closings. Florida Administrative Code Rule 69O-186.008 states, in pertinent part, “a title insurance agent or title insurer may not disburse funds unless the funds are collected funds. For purposes of this provision, ‘collected funds’ means funds deposited, finally settled and credited to the title insurance agent’s or title insurer’s trust account.”

Additionally, per Florida’s Rules Regulating the Florida Bar, Rule 5-1.1(j), states, “a lawyer generally may not use, endanger, or encumber money held in trust for a client for purposes of carrying out the business of another client without the permission of the owner given after full disclosure of the circumstances…a lawyer may not disburse funds held for a client or on behalf of that client unless the funds held for that client are collected funds. For purposes of this provision, ‘collected funds’ means funds deposited, finally settled, and credited to the lawyer's trust account…a lawyer's disbursement of funds from a trust account in reliance on deposits that are not yet collected funds in any circumstances…when it results in funds of other clients being used, endangered, or encumbered without authorization, may be grounds for a finding of professional misconduct.”

Long story short, unless funds are “collected,” they are not available to use in the transaction and are not secure to be legitimate funds, or incapable of being reversed or clawed back. The only form of funding a transaction that ensures the funds are immediately “collected” upon deposit is by wire transfer. In any other form, the closing agent woule be taking on enormous risk that the funds could be reversed or dishonored, or the closing agent could be violating Florida Bar ethics rules for utilizing other clients’ funds pending the deposit becoming “collected”.

For these reasons, be mindful to guide your clients correctly by setting expectations early on in the transaction that they will need to wire their funds for closing. Of course, we are always available to assist in walking them through the process of wiring funds, and working through our security protocols regarding the delivery of wiring instructions.

This blog is intended for informational purposes only and it is not intended to be, nor should it be construed as, legal advice or legal opinion. The reader should not consider this information to be an invitation to an attorney/client relationship, should not rely on information presented here for any purpose, and should always seek the legal advice of counsel in the appropriate jurisdiction.